Who is Tony Raffin?

Over The past three decades, Tony has made every real estate mistake imaginable, and in the process, he has closed over $1 Billion in sales. He's been featured in the Wall Street Journal as one of the top 10 real estate agents in the country, and was Nominated to The Forbes Real Estate Council.

AS SEEN ON:

Lorem ipsum dolor

Early Life

Tony Raffin has been hustling since he was a young boy.

Koolaid stands, collecting bottles, delivering newspapers, working on a meat market at 14 years old, always trying to make a buck, working hard wasn't ever a problem. Hard work is his mantra!

Selling Real Estate has become second nature now, becoming one of the Top Agents in the country, being recognized in the Wall Street Journal, and now on THE FORBES Real Estate Council have been some of his greatest achievements!

Career

Tony and his Detroit, MI, team run a wholesale business alongside their retail business, so no one ever goes hungry in this feast-or-famine industry.

His book Real Estate Secrets: How to Make More Money in Less Time by Avoiding the Top 13 Mistakes Most Beginning Real Estate Agents Make is a must-read for every beginning real estate agent.

Experienced agents will want to get on the wait-list for his GDPE (Graduate Distressed Property Expert ) course, which condenses Tony's 29 years of distressed property experience into one easy-to-follow masterclass and shows how anyone can build a solid real estate business, even if the economy tanks.

Tony got into real estate to make money, but that's not what has kept him there for almost 30 years. He not only loves helping people find the right house but also helping agents learn how to run profitable businesses by showing them how to do what he's done and how to avoid the mistakes he's made.

The Raffin Team

The Raffin Team Started over 20 years ago when Tony Raffin decided to run his real estate business LIKE A BUSINESS.

After spending tens of thousands of dollars on coaching from some of the best in the business, it was Tony's turn to be the best in the business and so the Raffin Team was concieved.

After closing over 7000 transaction sides and over One Billion dollars in Real Estate Sales we have hit most every award in the RE/MAX System, and we are just getting started. Want us to help you find a new home or sell your current home, click on the picture on the left and let us help GET YOU HOME!

The GDPI

The Graduate Distressed Property Institute has been a dream of Tony's for several years.

The development of The GDPE Course was a long time in the making, with over 20 years of distressed property knowledge and expertise, our course teaches you the systems and stratagies to fast track your results.

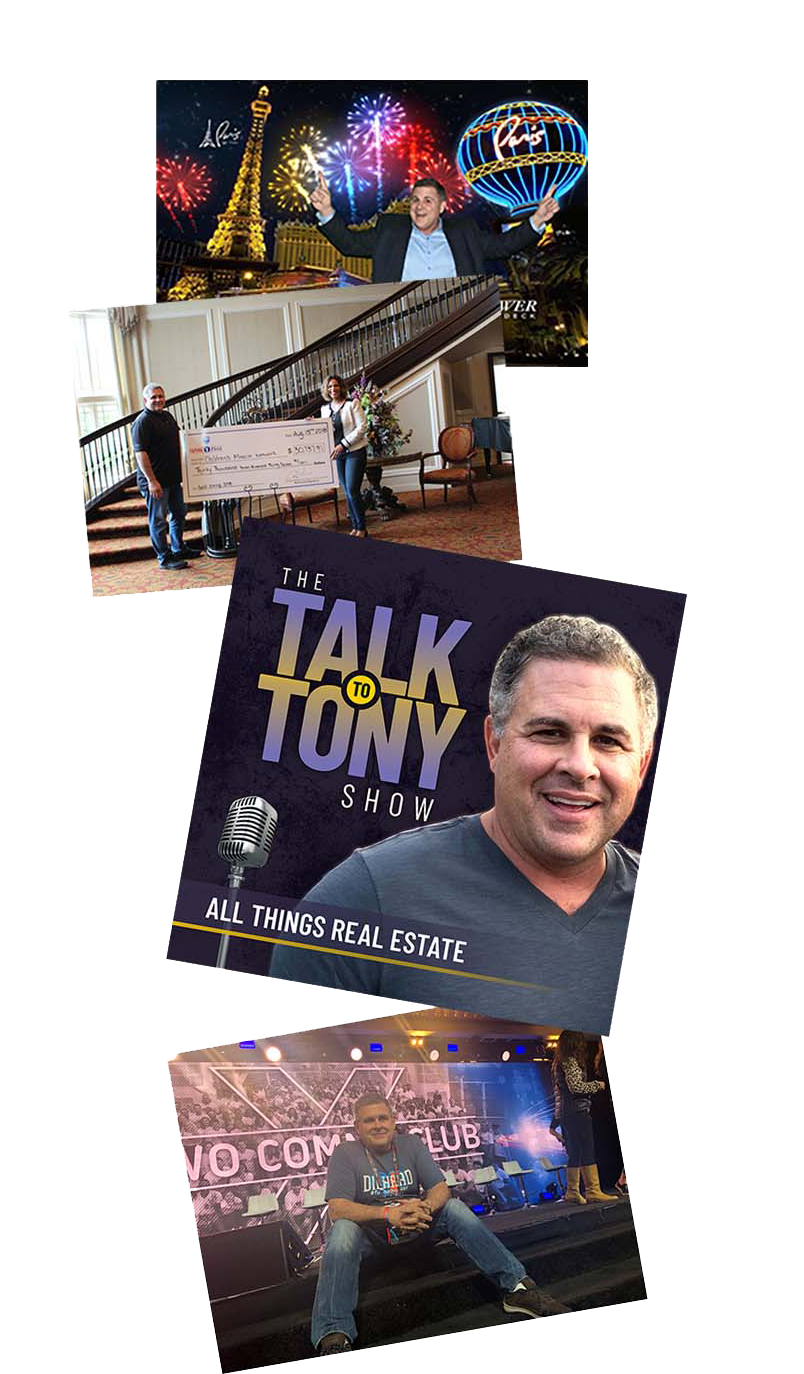

Giving Back

Children's Miracle Network has been near and dear to our hearts for a long time now and a portion of our proceeds always go towards helping Children in Need, our Annual Golf Outing raises record dollars every year

Racing Life

Racing Pro Modified Class in the America Drag Racing League was one of the highlights of Tony's Racing Career behind the wheel of his 2800+ HP Larry Jeffers 70 Cuda, along with a 3 year stint racing his 33 ft Fountain Powerboat in the American Powerboat Association Racing Series.

GET TO KNOW TONY BETTER:

Lorem ipsum dolor sit amet,

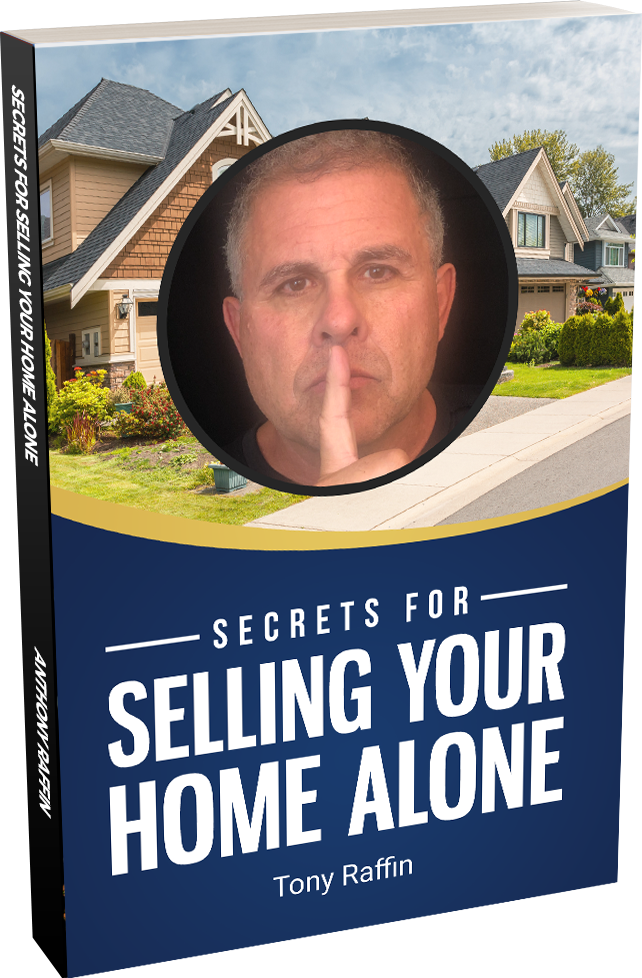

TONY'S BOOK

It is available here , just click the link below and get your copy FREE, just pay shipping!

SECRETS FOR SELLING YOUR HOME ALONE:

HOW TO SELL YOUR HOUSE FASTER, AND FOR MORE MONEY

This book has been a work in progress for 5 years and is ready to ship, and best part is, its yours for free! Just pay a small shipping charge.

Fix it and Flip it Podcast

So.... the big question is this .... how are entrepreneurs like us..... who didn't grow up with a family that had money to fund our ambitions get the capital and get the knowledge and experience to start fixing and flipping homes... That is the question and this podcast .... will give you the answers.

The Talk to Tony

Vlog

So what is your question...... that's what this is about....Real Estate Questions you want answered .... and we try to answer them as best as we can so tune in at the TalktoTony Vlog

POPULAR EPISODES:

Episode # 11

Kevin Stripling from Home Inspection Professionals is our guest talking about the importance of The Home Inspection

Episode # 14

Live on location from Nassua, Bahamas, our guest is Samuel Moss a man who survived 10 days in the Atlantic Ocean when his boat capsized in a storm, talking about not giving up!

Episode # 5

Our Guest John Zerka , Flipper from Flint, who has flipped over 1000 homes, teaches us a thing or two about the game we call Fix it and Flip it!

THE RAFFIN TEAM

Over 7,000 closed transaction sides and over $1 Billion in sales closed!

The Real Estate Team that gets you home!

Everything we Touch Turns to Sold!

Don't take our word for it

Read a few of our testimonials down below!

Read some Seller Testimonials?

I am a widow and I needed my house sold..I had contacted quite a few real estate agents and Tony was the only one who responded. I met with Tony and I could tell that he was very down to earth and took an immediate interest with my needs. There was no way that I could of sold this house without his help. I called him my guardian angel. I wasn't just dollar signs to him. I would recommend Tony if anyone is looking for a hard working..reliable..trustworthy agent. Tony is the agent you are looking for. What I was most impressed with is that when Tony tells you that he will do something he won't let you down..he will get you the best price for your house. The bottom line is that you won't find a better agent to handle your house. Tony is very honest and tells it like it is which I really appreciated. I can't thank him enough! -

Rosemary S.

Read some Buyer Testimonials

Tony was a referral from a close friend of mine, and I hope that this review encourages others to contact his firm. What makes Tony different than any other real estate professional is that he cares. Tony is looking for the peace and comfort of his clients. He seeks to truly understand what his clients are looking for from location, price and style. Tony also helped me better understand what I was looking for, reminding me of the features that I enjoy and use in my home and how to find those features in the next one. His experience speaks for its self and all his accolades are impressive, but it is his personal touch that makes working with Tony and the Raffin Team so enjoyable. Tony took the time to go through multiple listings with me and sometimes twice on Sunday. I will never forget my experience with Tony; not only because he found me my dream home, but because he personally treated the relationship like he was looking for his dream home as well! Tony is a blast to work with and we have created a friendship because of it. - Russell M.

Read some agent Testimonials

When a problem came up, Tony is always on top of it. He is a team player and an inspiration to work with.

I feel that he is a great asset to RE/MAX as well as all of his sellers now and in the future."-

Heather A.

Lorem ipsum dolor

WORK WITH TONY

Buy or sell your home with Tony & his Team

Looking to buy a new home or Sell your existing home?

Look no further, Tony and his Team of seasoned agents can help you buy that dream home you have had your eyes on.

But if downsizing or moving up is in your future, we can help you get top dollar for the home you're currently in. Don't take a chance with someone that doesn't have the marketing skills or the experience, The Raffin Team has you covered!

Hire Tony

Information on 1:1 Consulting & Speaking Engagements

If you're interested in consulting or speaking with Tony Raffin, his fees for events are below:

- Interview Tony on your podcast - Schedule on Calendly.com here: Click to Schedule

- Lunch - (to pick his brain) Starts at $500 and on location in Great Detroit areas

- Speaking Engagements - $5,000 or 50% back of room sales (whichever is higher)

- Build a Foreclosure Team on Location - $10,000 plus travel and expenses